You may have read our articles about the broad considerations relating to retirement planning, inheritance and estate planning and investment planning along with practical ways we can help.

In this guide, read about the key issue of tax planning.

Here’s an overview of taxation, and six key considerations you should bear in mind when it comes to developing a successful strategy for managing your tax affairs.

1. How Income Tax is charged

Income Tax is payable on several types of income. These include:

- Employment, including consultancy work and self-employment

- Rental income from buy-to-let or commercial property

- Dividend income

- Income you accrue through the interest on savings

- Income from investment bonds.

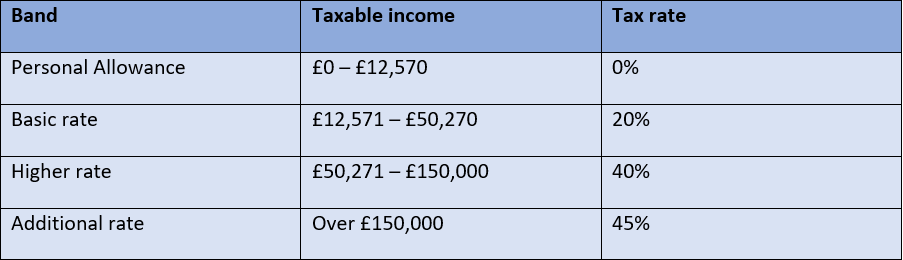

The table below sets out the current rates of UK Income Tax for the 2021/22 tax year.

Note that these rates apply in tax year 2021/22, but the chancellor has confirmed that these thresholds will be frozen until 2026. This means that, as your income goes up in the next four years, it’s likely that the amount of tax you pay at the higher and additional rates will increase.

2. Using your tax allowances effectively

When it comes to considering the amount of Income Tax you pay, it’s important to be aware of various allowances that, if used correctly, can significantly reduce the amount you pay to HMRC.

Here are five examples of available allowances:

- The Personal Allowance of £12,570 applies to all individuals over 18, regardless of the amount they earn or receive in savings income.

- Depending upon your overall level of income, you may benefit from the starting rate for savings which is £5,000 for savings related income.

- In addition, there is also a Personal Savings Allowance of up to £1,000 if you’re a basic-rate taxpayer or £500 if you’re a higher-rate taxpayer (figures correct in 2021/22 tax year).

These first 3 allowances mean that you and your spouse or partner could receive over £37,000 tax-free annually if you structure your income effectively.

- You get an annual Dividend Allowance, which is £2,000 in the 2021/22 tax year. This means that the first £2,000 of dividend income you receive is tax-free.

- You can also save up to £20,000 into Individual Savings Accounts (ISAs) and £3,600 gross into pensions in the 2021/22 and 2022/23 tax years. Your money will then grow free from Income Tax and Capital Gains Tax and over several years can build additional tax-free income streams.

Also bear in mind that, although it’s not an allowance, you can take 5% of your initial investment tax-free from an investment bond each year.

As you can see, it’s possible to structure a very tax-efficient income just by using your allowances correctly – for both yourself and your partner.

In a separate article, we’ve outlined a seven-step approach demonstrating how you may be able to generate tax-free income of over £60,000 by simply using your available allowances.

3. Understanding how Capital Gains Tax is charged

As the name suggests, Capital Gains Tax (CGT) is payable on the profit you make when you sell an asset. This includes:

- Stocks and shares

- Unit trusts

- Buy-to-let residential property that doesn’t qualify for principal residence relief.

Your annual CGT allowance allows you to take profit up to £12,300 each year free of CGT (this allowance is fixed until 2026).

If you’re a higher or additional-rate taxpayer, you’ll pay CGT at 28% on residential property and 20% on other chargeable assets.

Basic-rate taxpayers will pay CGT at 10% up to the basic-rate Income Tax band (or 18% for residential property).

You don’t have to be a UK resident to be liable to CGT. For example, IHT is potentially chargeable on UK residential property gains since 2013.

By also utilising your CGT allowance alongside the various income tax allowances outlined above, a couple can generate over £60,000 in tax-free income and gains for meeting your expenditure requirements,.

4. The difference between “residence” and “domicile”

Establishing your tax status is important when it comes to managing your financial affairs in the UK if you’re internationally mobile.

This is dependent on your residence and domicile status. Both are complex terms with different definitions.

Residence

Residency is generally based on the number of days you spend in the UK in a relevant tax year and a HMRC assessment of the ties you have with the UK.

This assessment is usually referred to as a “Statutory Residence Test”.

Take a look at our residency test flowchart and dedicated guide for more details about this.

Domicile

While there is no single legal definition of your country of domicile, it will often be established according to three factors:

- Where you were born

- If you have assets in a particular location

- Where your father was born.

We would add a further criterion when advising our clients about domicile in that it’s led by where you live permanently and indefinitely.

When it comes to determining your country of domicile, HMRC will interpret the conditions and draw their own conclusion about whether you are still domiciled in the UK.

For both residence and domicile queries, we’d strongly recommend you seek advice and guidance from an experienced adviser.

5. The importance of Inheritance Tax planning

You can find out more about Inheritance Tax (IHT) and estate planning in a previous article.

However, it’s worth bearing in mind some key points when it comes to this important issue:

- Even if you’re an expat living outside the UK, you’ll still be subject to IHT if you’re still regarded as UK-domiciled.

- If you are not regarded as UK-domiciled, only UK-based assets will be liable to IHT.

Given the complexities involved, we would strongly recommend that you get advice from a financial specialist when it comes to managing your finances in respect of IHT.

There are a series of ways of mitigating the impact of IHT, but mistakes can prove costly.

For more comprehensive information, find out more in our UK Inheritance Tax guide which you should find useful.

6. Managing your tax affairs as an expat

If you are living and working abroad as an expat, managing your tax affairs can be complicated. It’s also easy to make costly mistakes that can result in you receiving an unwelcome tax bill.

So, it’s important to ensure you structure your affairs so that you’re paying the right UK taxes. By doing this, you can also maximise the financial advantages of being an expat.

Beyond that, it’s also important to structure your tax affairs correctly when you’re in the process of returning to the UK – either to continue working or to retire. Whilst the UK does have higher rate of tax than Hong Kong, with some carefully planning many of these can be mitigated.

Get in touch

If you need help or guidance regarding any of the key tax issues raised here, please get in touch.

You can contact us by email or, if you prefer to speak to us, you can reach us in the UK on +44 (0) 208 0044900 or in Hong Kong on +852 39039004.

Production

Production