One subject that we proactively discuss with prospective clients concerns the matter of investment charges. It’s important to understand what the various charges are likely to be, how much they typically are, and what they relate to, before engaging a financial planner, in order to avoid any nasty surprises further down the line.

We looked at this in some detail in a previous article that looked at the different types of charges you may have either read or been told about.

In this article, you can read about the charges on one particular investment product you are likely to have come across – an offshore bond (as known as an insurance bond or portfolio bond).

Offshore bonds can be a highly tax-efficient way to invest

Offshore bonds are a common investment option, particularly for expats and the internationally mobile who spend extended periods outside the UK.

They provide tax deferral features that give you valuable flexibility around your tax affairs when you cash in some, or all, of your bond.

Furthermore, putting your bond in a trust may mean you or your beneficiaries can offset or wholly mitigate taxes due when transferring your wealth.

Many bond charges can be opaque or misleading

However, the fee structure on many offshore bonds can often be opaque or confusing.

Because of this, many unwary investors will put money into an offshore bond, only to subsequently find that high commission charges and excessive ongoing management or administration costs can eat into the long-term value of your fund.

This means that offshore bonds work well for many investors for who they are suitable, but only when they are not subject to commission charges and high ongoing costs.

Comparing the pricing structure of offshore bond options

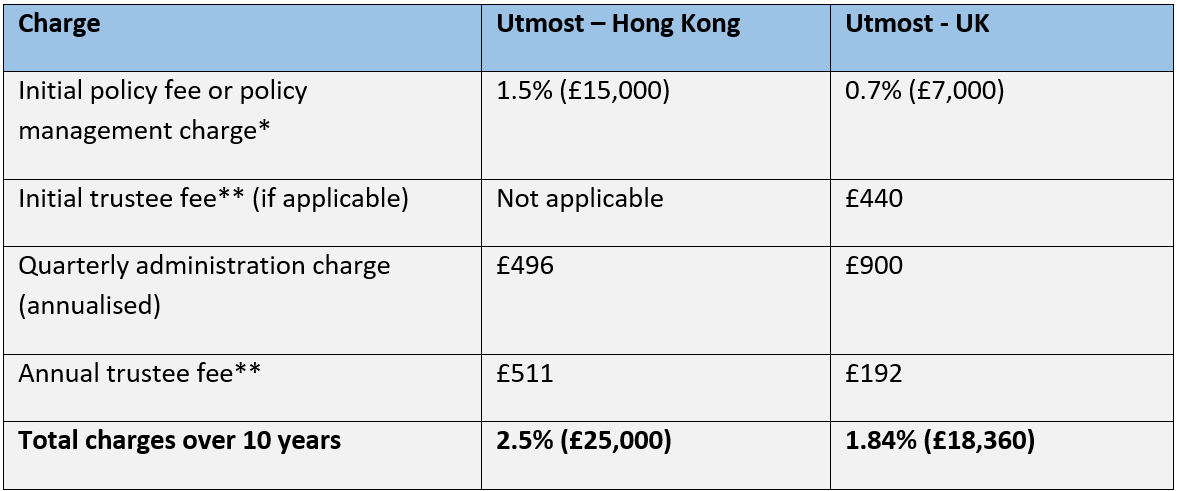

To give you an idea of the charges you should expect to pay, the table illustrates the differences between UK-priced offshore bonds and the same bond available in Hong Kong.

To ensure a fair comparison, we have selected the same provider for both.

These figures are based on an investment of £1 million.

*The Hong Kong policy charge is taken over five years in quarterly instalments, so 0.075% per quarter, or 0.3% per annum. The UK policy charge is taken upfront.

**The trustee fees aren’t a necessity. However as a trust may be recommended to achieve a planning objective, then we have included the costs here.

The payment and receipt of commissions has been banned in the UK under regulations brought in at the end of 2012.

The truly professional financial advisory firms had already been operating on a fee-only basis for many years prior to this date without the need for the regulator to enforce this.

These regulations were introduced in a bid to professionalise an industry, increase transparency, and remove an obvious conflict of interest. Unfortunately, the offshore bond providers and financial advisers serving the Hong Kong market, and other overseas jurisdictions, are not bound by such regulations with the payment and receipt of commissions still being common practice.

So you need to beware. If you are quoted the costs for an offshore bond and the initial policy fee or policy management fee is any higher than shown on the first line of this table, then your financial adviser will be receiving a commission from the offshore bond provider for introducing your business.

Get in touch

If you would like to discuss your own offshore bond requirements, please get in touch.

You can contact us by email or, if you prefer to speak to us, you can reach us in the UK on +44 (0) 208 0044900 or in Hong Kong on +852 39039004.

Production

Production