Your investment strategy will be the engine that drives your financial plan.

With the right strategy, you’ll give yourself the best possible chance of securing your long-term wealth and ensuring you can enjoy the retirement you’ve worked hard for and looked forward to.

There’s no doubt that there are some risks involved with investing your money. However, to my mind one of the most commonly perceived risks, that of volatility, isn’t actually a risk at all.

But having the right plan in place and taking steps to avoid or mitigate these risks can, if you can excuse the pun, pay dividends in terms of long-term investment performance.

Discover what some of these risks are, and the steps you can take to help secure your future financial security.

Investment volatility is a threat, but perhaps not in the way you think

Investment markets are naturally volatile. This is primarily because they can be affected by a host of external influences, which can affect them in different ways.

The key point to remember is that there are just as many positive factors that can affect markets as negative ones. This means that rather than fear volatility, you should welcome it as it’s a natural part of the way markets behave.

Don’t just take my word for it! The investment sage, Warren Buffett, said: “If the investor fears price volatility, erroneously viewing it as a measure of risk, he may, ironically, end up doing some very risky things”.

Indeed, somewhat counter-intuitively, it’s important to realise that in reality, low volatility can be just as risky as high volatility.

Low volatility investments, such as government bonds, carry less risk in the short-term, but more risk over longer periods when compared with higher volatility investments, such as equities.

This risk derives from the fact that you may well end up depriving yourself of the potential long-term growth you could generate from supposedly “riskier” investments.

Furthermore, while there is a place for cash in your financial planning – your emergency fund, for example – holding too much cash in your investment portfolio is, paradoxically, a potentially high-risk strategy.

This is because inflation is likely to reduce the purchasing value of your cash over time and, again, you’ll be missing out on the potential of investment growth.

It’s important to accept volatility as being an inevitable part of how markets behave and see it as an asset that can grow your wealth, rather than a threat.

Long-term investing reduces the risk posed by market turbulence

Clearly, the components of your portfolio are important, and you need to be comfortable with your choices. But often investment success can be derived from the length of time you invest for rather than any particular fund or share.

Market turbulence can pose a short-term risk to your portfolio, as it can easily reduce the value of your holdings.

But, it’s important to appreciate that when you hold assets for a long period, you are actually reducing the risk market turbulence can pose. Additionally, you will benefit from the long-term effect of dividend payments that, when reinvested, can add value to your portfolio through the power of compounding.

Once again, there’s a quote from Warren Buffett that nicely sums up the importance of looking at investment as a long-term undertaking: “Our favourite holding period is forever”.

Inflation can reduce the purchasing value of your retirement savings

Instead of being concerned about investment volatility, it’s better to simply see this as being inevitable and, as you have already read, appreciate that it will have little effect on the long-term value of your portfolio.

Inflation, on the other hand, is a much bigger threat. However, many investors tend not to appreciate this, or believe that its effect is exaggerated.

An extended period of high inflation can play havoc with the purchasing power of your wealth and erode the real value of your savings and investments.

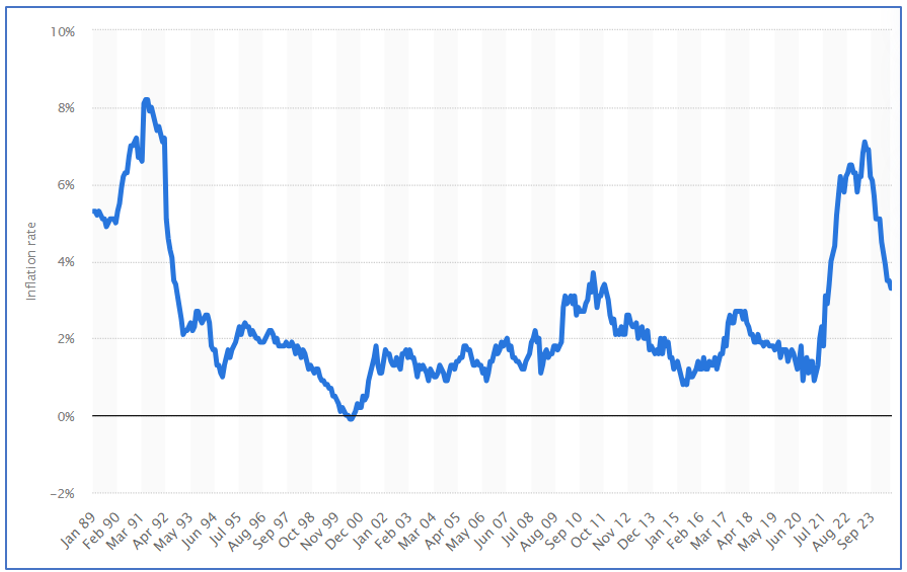

UK CPI inflation rate from 1989 to 2024

Between 1992 and 2021 we enjoyed nearly three decades of an inflation rate below 4%. This perhaps convinced us that it was now a fact of life and had become baked into our economy. However, the sudden increase, which was caused primarily by a series of external factors, including the Russian invasion of Ukraine, and the post-pandemic surge in demand, should have given you pause for thought.

As a result, it’s important to ensure your investment strategy is geared towards mitigating the impact of inflation as far as possible.

Your personal behaviour could be the biggest threat to your future wealth

When it comes to identifying investment risks, potentially the biggest could be staring back at you when you look in the mirror!

Indeed, the risk can often boil down to how you react to market volatility, rather than the volatility itself.

Reacting to every market movement, with euphoria when markets rise and panic when they fall, can result in you potentially making expensive investment mistakes.

One simple way to mitigate this particular risk is to not check the value of your investments too often.

I’ve mentioned here before the comment of a fellow financial planner who said that the value of an investment portfolio will rise in inverse proportion to the number of times you check it.

He was obviously exaggerating for effect, but there’s an underlying truth there for you to be aware of.

This point underlines the importance of having a robust investment plan in place for your finances and investments. Then, once you have a plan you’re happy with, you need to stick to it, and not be tempted to make changes as and when you’re faced with problems.

Changing your investment strategy in the event of any kind of market volatility, whether values are increasing or falling, is highly risky. It’s important to factor in an element of investment volatility into your plan, so by making short-term adjustments you may well end up jeopardising your future financial security.

You won’t be surprised to learn that there’s another Waren Buffett quote to illustrate this important point: “Risk comes from not knowing what you’re doing”.

Putting all your investment eggs in 1 basket could be higher risk than you think

Another common investment risk is having too much of your money invested in one particular region, market sector, or commodity. You may see this referred to as “concentration risk”.

As you have already read, markets are affected both positively and negatively by external factors. It’s important to realise that they react differently to these factors.

For example, something that is good for the US economy and increases the value of US stocks may have the reverse effect on European or Asian markets.

An effective spread of investments in your portfolio can help dampen the effect of any short-term volatility in one particular area.

A subset of this risk is known as “home bias”, which is effectively the tendency to invest in markets and companies in the country you live in, rather than diversifying across different countries and regions.

Likewise, it can be sensible to avoid any over-concentration in a fund, or funds, managed by a particular fund manager.

The investment industry is always keen to promote its apparent “star” fund managers and bestow on them the abilities of King Midas. In reality, they can be just as prone to human error as the rest of us. That’s why I’ll also encourage you to ignore the hype and effectively diversify your investment portfolio.

Get in touch

If you have any queries about your investment strategy, please contact us by email or, if you prefer to speak to us, you can reach us in the UK on +44 (0) 208 0044900 or in Hong Kong on +852 39039004.

Production

Production