In March this year, FTAdviser reported that more than £27 billion was paid in Inheritance Tax (IHT) in the four year period up to the end of 2021.

The same report also confirmed that the Office of Budget Responsibility are projecting that amount to increase by 36% in the next four-year period.

The rise is predominantly driven by the continuing escalation in property values and a freeze on key IHT allowances until 2026.

The two applicable allowances are:

- The nil-rate band (NRB) of £325,000. This is the threshold above which your estate will be liable for IHT, paid at 40%

- The residence nil-rate band (RNRB), which is an additional allowance of £175,000 applicable if you leave your residential property to your children or grandchildren.

IHT is clearly an issue to take very seriously when it comes to your estate planning.

You can read a previous article about estate planning which gives a high-level overview of IHT and how it’s charged.

In this article you can read all about ‘gifting’, which is just one of the ways of reducing your estate’s exposure to IHT.

You need to have a clear idea of your estate planning objectives

It’s important you understand what your overall estate planning objectives are, before you start taking the steps you’ll read about in this article.

Gifting some of your assets while you’re alive enables you to leave a legacy to your beneficiaries that they can benefit from during your lifetime. You therefore have the pleasure of seeing your assets make a real difference to them. There’s no “one size fits all” answer with regard to the timing of gifts. We’ll produce an article for you on this subject in a future newsletter.

Alternatively, you may prefer them to stand on their own two feet and only benefit from the value of your estate after you die.

The decision is personal to you. It’s important you have a clear idea of your intentions, as they should form a key part of your financial planning process.

Cashflow forecasting has a key part to play

Almost every step of your financial planning journey can be informed by cashflow forecasting, and the making of gifts is no exception.

To begin with, it can confirm to you the affordability of making any gifts.

It can then also help you see the long-term impact of gifts on the overall value of your estate. This can be even more informative if you include the effect of inflation and potential investment growth.

Making use of gift exemptions

You can reduce the amount of IHT payable when you pass away by gifting some of your assets while you are still alive.

As a rule of thumb, your beneficiaries will not pay IHT on the value of anything you gift to them if you live for seven years after the date of making the gift.

However, there are some gift exemptions where no IHT will be payable, regardless of how long you live.

For example, you can gift a total of £3,000 each year to one or more beneficiaries and this amount will immediately fall outside the value of your estate. This can be carried forward for up to one year if not used.

You can also make exempt gifts for weddings or civil ceremonies and payments towards the living costs of elderly relatives.

You can also make individual gifts of up to £250 to anyone who has not benefited from any other of your exemptions during the year.

Gifts to UK political parties and registered charities are also exempt.

Assets passing between you and your spouse

Any assets passing to your spouse on your death are exempt from IHT if you are both UK-domiciled.

However, if one of you is UK-domiciled and the other is non-UK-domiciled, there is a maximum of £325,000 that’s exempt from IHT when passing to the non-UK-domiciled spouse. In addition, the usual Nil Rate Band and Residence Nil Rate Bands may be available. Any amount above that figure is not exempt and chargeable to IHT.

For lifetime gifts to a non-UK-domiciled spouse, unfortunately the “seven-year rule” does not apply – gifts are subject to the same £325,000 and apply on a lifetime basis – so once exhausted are fully used and cannot be refreshed.

You can read more about this in the next section.

If you are in this situation, we would strongly recommend you get expert advice.

Potentially exempt transfers and the seven-year rule

Non-exempt gifts are known as potentially exempt transfers (PETs). They are only exempt from IHT if you live for seven years from the date you make them. You may have heard of this referred to as the “seven-year rule”.

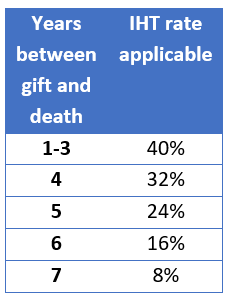

Tapering relief can help mitigate the effects of the “seven-year rule” on IHT being payable on non-exempt gifts you make.

The full rate of 40% IHT is payable if you die within three years of making the gift. After that time, the taper mechanism reduces the amount payable year-on-year.

However, taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

Given the IHT implications of PETs, it’s important that you keep records of the gifts you make including the exact date you made the gift and full details of the recipient.

You should keep these records with your other financial paperwork so that, in the event of your death, your executors have clear details of the assets you’ve gifted.

Gifts with reservation of benefit

A “gift with reservation” occurs where you transfer ownership of an asset to a chosen beneficiary, but you then continue to benefit from it following the transfer.

One common example of this is when you gift your home to your children and continue to live in the property without paying any rent.

In this instance, the gifting of your property will likely fail for inheritance tax planning purposes

Gifting assets through the use of trusts

One tax-efficient way you can transfer your assets to reduce the IHT liability on your estate is by using trusts.

By putting assets in trust, you’re effectively ceding control of them to the trustees, so the assets sit outside the value of your estate for IHT purposes.

Not only that, but by using a discretionary trust you are also able to specify through an accompanying expression of wishes, when you’re setting the trust up, how the trustees should manage the assets.

For example, rather than making an outright gift, passing money to your children or grandchildren by means of a trust enables you to state when they should receive the gift. This can be particularly useful if you think they are currently too young to spend it prudently.

Your trustee then has full control of the assets in question.

Get in touch

If you need any advice regarding the gifting of your assets, or any other aspects of estate planning, then please get in touch.

You can contact us by email or, if you prefer to speak to us, you can reach us in the UK on +44 (0) 208 0044900 or in Hong Kong on +852 39039004.

Production

Production