Every so often I’ll have a conversation, or series of discussions, with one of our clients that brings home to me the true underlying value of the planning advice we offer and the services we provide.

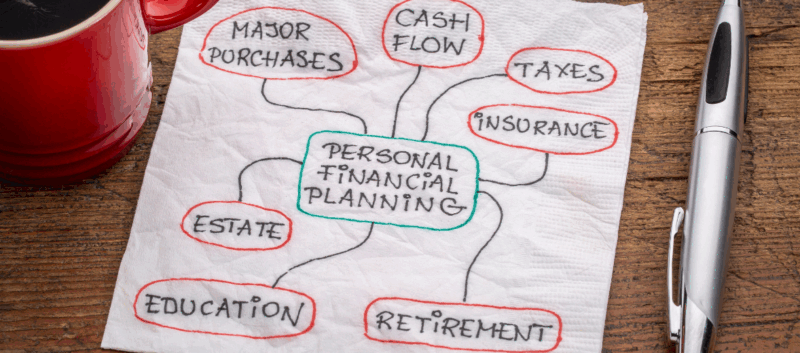

While it’s clear that part of my role as financial planner is helping you grow your wealth, I firmly believe that the real value in what I can do for you is more about helping you understand what is important to you, so the decisions we arrive at can deliver clarity, confidence, and contentment – what I call our ‘3 C’s’.

A great way of illustrating this is through the story of one particular client, and his family. It should help bring to life the real power of financial planning, which is about far more than tax and investments.

Tony saw working in Hong Kong as a lucrative career move

A few years ago, Charlton House started working with Tony (not his real name) who had approached us in advance of his return to the UK after spending a number of years living and working overseas in Hong Kong.

I’ve learned that Tony is a very humble person, and a highly qualified technical business consultant whose specific skills are in high demand across the globe.

His reasons for working overseas will be familiar if you yourself are an expat or a former one.

Tony was in Hong Kong to accelerate his professional career (opportunities come along more frequently in such transient economies), to earn a significantly greater salary than an equivalent role in the UK would offer, and also to be able to earn that money in a tax-friendly jurisdiction.

Of course, the warmer weather and avoiding the UK winters was also a big lure!

Tony’s family stayed in the UK while he worked in Hong Kong

During the time Tony was overseas, his family – wife, daughter and, then later, his son – remained living in the UK.

While he travelled back to see them as often as he could, the demands of his job meant this was never as often as he would have liked.

This affected Tony considerably. His daughter was only six years old when he left for his overseas assignment, and upon his eventual return, had reached the age of 12.

His commitment to his job meant that while he amassed significant amounts of wealth during his time overseas – to the extent that by his late 40’s he is financially independent – it came with the sacrifice of not being as present as he would have liked for his daughter during some of these formative years of her life.

We helped Tony plan his return to the UK

When he finally made the move to return permanently to the UK, we assisted Tony with some pre-UK residency tax planning and other repatriation financial advice.

We helped him structure his savings and investments to ensure they became as tax-efficient as possible. We also advised him with regard to his longer-term goals and financial objectives, including estate planning advice to ensure he minimised his Inheritance Tax (IHT) liability.

As with all our clients, a key part of the planning was showing Tony cashflow planning projections, which allowed him to appreciate, for the first time, that he was actually financially independent.

Tony gets the opportunity to take a highly paid job overseas

For the next two years, we helped Tony and his family with their routine financial planning arrangements, such as ensuring that both he and his wife maximised their ISA and pension allowances.

Then, the other week, he sent me a message on WhatsApp to request a call. It sounded urgent, so I quickly cleared a gap in my diary and contacted him.

He told me that he had been offered a job overseas which, net of tax and additional expenses, would give him an annual income of five times the salary that his UK job currently provides.

His questions to me revolved around the tax implications of leaving the UK midway through a tax year, all of which we discussed, and I used our statutory residency flow chart to assist in this conversation.

He then told me he was in a bit of a conundrum: on one hand he could earn five times what he was earning in the UK. Yet on the other hand, he explained to me how, since he’s been able to live back in the UK, it is he who wakes his daughter up every morning by holding her hand.

At the end of the call, I left him with one question: do you need the money, Tony?

After a sleepless night, Tony asks for my advice

The next day, he called me back. He confessed that he’d had a sleepless night and asked if we could have a quick look at the most up to date cashflow forecasting charts I had prepared for him.

So, we jumped on a Zoom meeting. I shared my screen, and we had a look to see how wealthy he would be by the age of 100 if he took on this job for the next few years.

But we also looked at the alternative scenario of him retiring now, with no more income coming in for the rest of his life. This clearly showed him that he was still going to be a very rich man at 100 years old.

Despite seeing these forecasts, I could see he was still undecided. So I asked him a question.

“Would you like to know what I would do if I was you?”

“I was hoping you would ask me that. Yes, please!”

I responded by telling him not to take the job. I pointed out that life isn’t a rehearsal, and he will never get back that time, which is the most finite of all commodities.

The real value of financial planning

I have to say that, for me, this was a moment of massive professional pride.

Some people think that financial planning is all about investing and tax. But real planning is about working out how much is “enough” and helping clients to truly define what is important to them.

If I do this properly, we build a mutual trust where you can make financial decisions with absolute clarity, confidence, and contentment.

Get in touch

If you would like to discuss your own financial planning arrangements please get in touch.

You can contact us by email or, if you prefer to speak to us, you can reach us in the UK on +44 (0) 208 0044900 or in Hong Kong on +852 39039004.

Production

Production