As someone who advises clients about their investment strategy, I’ve long had a deep regard for Warren Buffett.

Indeed, it’s not hyperbole to suggest that he’s one of the most successful investors in history.

Along with his long-term business partner, Charlie Munger, he turned Berkshire Hathaway (BH) from a declining textile producer into an extraordinary conglomerate that, according to MSN, is now worth $1.16 trillion. This, based on Investopedia data, makes it the eighth-largest company in the world by market capitalisation.

That growth has led to remarkable returns. According to Business Times, the BH share price compounded by 20% a year during the time Buffett has been at the helm, twice that of the S&P 500 over the same period.

Buffett has always been happy to share his investment wisdom

Although he’s now 94, news that Buffett will be stepping down as chief executive of Berkshire Hathaway at the end of the year came as a surprise.

It could be because he’s always been so visible with no sign of slowing down, so we’ve all taken him for granted.

Throughout the years, he has been notably keen to share the secrets of his success. The primary vehicle for this was his annual letter to BM shareholders, always containing simple maxims and observations that were instantly understandable to the amateur investor.

I’ve read Buffett’s comments for years. As well as offering sound investment advice, his comments about running a business have resonated with me and I’ve borne them in mind as I’ve built Charlton House.

Here are five of my favourite Warren Buffett pearls of investment wisdom, which can provide a good starting point for long-term investment success.

1. “The stock market is designed to transfer money from the active to the patient”

Buffett has long preached the importance of patience and not simply carrying out investment trades for the sake of it or because you feel you ought to.

As he makes clear in another well-known “Buffettism”, “The trick is, when there is nothing to do, do nothing.”

Both of these echo the old adage that time in the market is more important than trying to time the market.

If you constantly make frequent trades and react to market fluctuations, you will tend to lose money. Conversely, if you are patient and hold investments for the long term, you are more likely to succeed.

2. “We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful”

The importance of not fearing stock market fluctuation has long been one of Buffett’s preoccupations.

He surmises that investment risk comes more from how you react to market volatility, rather than the volatility itself. This means that one of the biggest threats to your long-term wealth is to cash in investments after they have fallen in value.

Instead, you should see a sudden market downturn as an investment opportunity.

Buffett described this by saying that a “wildly fluctuating market means that irrationally low prices will periodically be attached to solid businesses”.

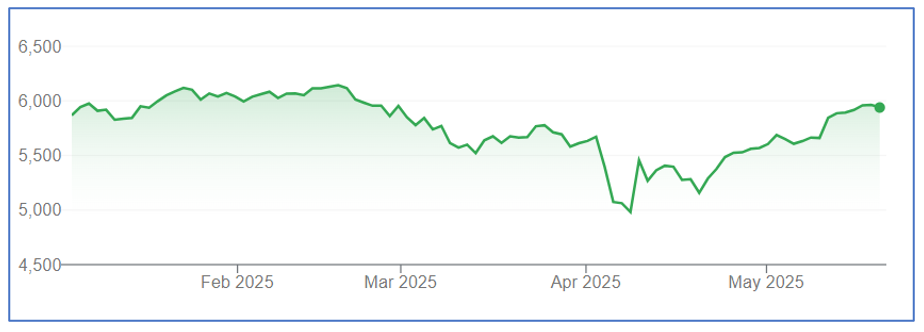

For example, after President Trump’s announcement of sweeping tariffs on 2 April 2025, the S&P 500 index fell precipitously, losing close to 14% of its value in just six days.

Yet just six weeks later, it had recovered all that lost ground, and more, to increase in value by 16% from that low point.

Source: Google

If you were fearful, you would have sold on the way down, or near the bottom of the market. Instead, by actually buying while the fearful were selling, you could have made a handy profit, while retaining your original stocks in your portfolio.

3. “Our favourite holding period is forever”

This is another quote Buffett has used to support his advocacy of long-term investing.

He went into this in more detail when, in relation to the value of a stock after one year, he asked, “Why should the time required for a planet to circle the sun synchronise precisely with the time required for business actions to pay off?”.

It’s a fair point!

While what is in your portfolio is important, successful investing can often come down to a matter of how long you invest for, rather than the shares you buy or sell.

By holding assets for the long term, you reduce the risk of short-term market turbulence blowing your investment plans off course. You also benefit from the long-term effect of compounded dividend returns.

4. “Risk comes from not knowing what you’re doing”

You don’t start a major project without a detailed plan, and this applies just as much to growing your wealth through your investment strategy as to anything else.

Not only that, but once your plan is in place, you need to stick to it, and not be tempted to make changes as and when you’re faced with problems.

Any robust plan will have an element of investment volatility factored into it. By making short-term adjustments, you may well jeopardise your future financial security.

After all, according to Morningstar, the percentage of active fund managers who beat their index in 2023/24 was only 14%.

When you consider that they have the benefit of being able to call on detailed research and analysis, it’s important to ask yourself why constantly changing your plans will help you do any better.

Find out more: How to correctly identify and mitigate risk in your investment portfolio

5. “Price is what you pay. Value is what you get”

With this often-repeated quote, Buffett is urging you to focus on the underlying value of an investment rather than the possibility of short-term gains.

The price you pay for a stock is a numerical figure that can fluctuate based on market conditions, the economic climate, and a host of other uncontrollable factors.

The value you gain, however, differs from that price. It’s the underlying worth of that company, which will come from controllable factors such as quality products, targeting the right markets, and effective business leadership.

In this regard, Buffett has practised what he has preached, with substantial long-term holdings in quality companies such as Apple, American Express, and Walmart.

Find out more: 8 investing mistakes and how you can avoid making them

Get in touch

If you would like to discuss your own investment strategy, please get in touch.

You can contact us by email or, if you prefer to speak to us, you can reach us in the UK on +44 (0) 208 0044900 or in Hong Kong on +852 39039004.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production