As you’ll be aware, in these monthly newsletters you can often read articles about different aspects of investing your money, and other investment-related issues.

For example, in the last year, I’ve written pieces about identifying and mitigating risk in your portfolio, the danger posed by offshore financial fraudsters, and, subsequently aborted, plans for a British ISA, to list just three.

One subject I have never written about, however, is cryptocurrencies – the most well-known of which is Bitcoin.

Given the recent publicity and the frequency with which stories about the massive success some people are having investing in cryptocurrencies are appearing in the media, I felt that I could no longer ignore the elephant in the room.

This is even more the case especially as the subject has come up at some recent client meetings, and the relatively recent launch of an iShares Bitcoin exchange traded fund (ETF).

Bitcoin is the world’s most prominent cryptocurrency

While you don’t need in-depth knowledge of all investment technology, I’ve always been keen to ensure that, as a Charlton House client, you have at least an outline idea of what you’re investing your money in.

Having that knowledge can help you understand how your portfolio can meet your financial objectives, and provide you with valuable peace of mind during inevitable periods of market turmoil.

So, when it comes to Bitcoin, the best way I can describe it to you is that it is effectively a currency or a digital payment system. It’s often been described, mainly by its proponents, as “digital gold.”

Its creation in 2008 in the wake of the financial crash reflected the lack of trust in financial institutions, and a desire to create a currency without the involvement of traditional financial systems or government authorities.

Bitcoin allows for peer-to-peer transactions outside of central intermediaries like banks. This is accomplished through blockchain technology.

Unlike traditional currencies, such as sterling or dollars, it is more akin to commodities such as gold that are “mined” rather than simply printed by a government treasury.

However, you can put away your picks and shovels because the mining in this case is carried out by complicated computer algorithms and highly expensive equipment.

Only a finite number of Bitcoins will ever be in circulation

Unlike other currencies and commodities, the supply of Bitcoins is fixed. The maximum number that will ever exist is just under 21 million and, according to Deutsche Bank nearly 90% of the total supply of bitcoin is already in circulation.

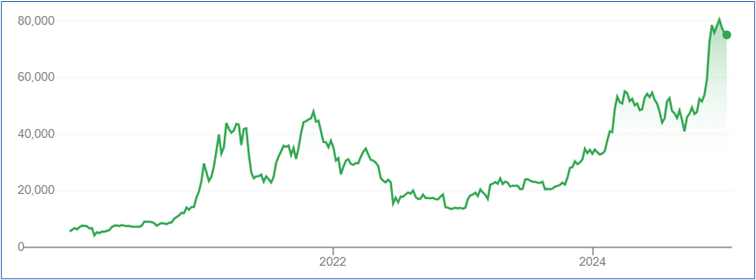

Proponents suggest that the deliberately limited supply can act as an effective hedge against inflation, although it also means that the value can fluctuate wildly, as you can see from the chart showing the five-year performance up to the end of 2024.

Source: Google

Bitcoin can be used as an online currency, but only by institutions that accept it, and the one country – El Salvador – where it is legal tender, as of January 2025.

Cryptocurrencies have been the subject of much controversy

One point I will always make about investing your money is the importance of transparency. You should always see opaque charging and management structures as a red flag, because it may lead you to wonder what the company managing your money is trying to hide.

So, the fact that the very word “crypto” derives from the Greek word kryptos, meaning hidden or secret, should be a big warning sign.

Furthermore, when it comes to cryptocurrencies, such as Bitcoin, there have a series of stories and revelations that should also be cause for concern.

The lack of regulation and any financial institution involvement means it has been accused of being the currency of choice on the dark web for illegal payments that leave no trace.

It also means that hackers usually demand to be paid in Bitcoin, or other similar currencies, during ransomware attacks.

You may also recall the high-profile trail of Sam Bankman-Fried who founded the FTX cryptocurrency exchange, and at one time was listed as one of the top 50 richest Americans. When he was exposed as a fraudster, the lack of any regulatory protection meant that thousands of investors lost money when the FTX exchange collapsed.

Then there was the case of Quadriga company’s CEO and founder, Gerald Cotten, who died in 2018 while on holiday in India. Again, the lack of any regulation meant that more than $250 million of cryptocurrency owed to 115,000 customers has never been recovered because he alone knew the password to the Quadriga systems.

Regulators are wary of Bitcoin and other cryptocurrencies

Given the controversies you have read about, and the expressed aim of cryptocurrency to avoid traditional financial institutions, you won’t be surprised to know that regulators are very wary of Bitcoin and other currencies.

In the US, the Securities Investor Protection Corporation (SIPC) does not cover crypto assets unless they are registered with the Securities and Exchange Commission, even if they are held by an exchange or firm that is covered by the SIPC.

Similarly in the UK a research note from the FCA makes it clear that cryptocurrency investment is unregulated, and that if you invest, you should be prepared to lose all your money.

Cryptocurrencies are a highly speculative investment option

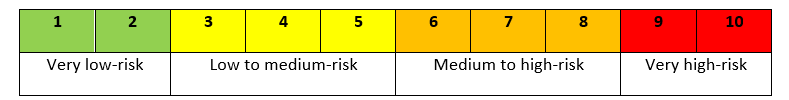

You may well have seen the risk rating of investments expressed on a simple scale of 1 to 10.

On this basis, very low-risk investments would include simple deposit accounts, and government-backed gilts, while at the other end of the spectrum, investments with a risk rating of 9 and 10 are highly speculative, such as shares in mineral exploration companies and start-up businesses.

I’d actually put bitcoin and other cryptocurrencies at 11 on that scale, because not only could you easily lose your money, but there is very little regulatory protection to prevent that happening.

Additionally, while it’s easy to understand how and why the value of most investments can rise and fall, cryptocurrencies like Bitcoin don’t appear to have that certainty. It’s a highly speculative investment, which seems to be based more on investor perception rather than economic indicators.

Because of this, I feel that it could easily be prone to external influences, such as the “pump and dump” process followed by unscrupulous investment fraudsters.

You may have looked at the recent rise in the value of Bitcoin, and considered that it could help boost the growth in your portfolio, but in the long term, global equities will do the job just as well, and you’ll have a much better idea of where your money is invested.

Ultimately, my recommendation is that if you do feel the urge to invest in cryptocurrencies, you should ensure you’re using what I describe as “play money” and be in a position where losing everything will not affect your wider wealth and financial plans.

Get in touch

If you would like to talk about your investments, and other financial planning issues, please contact us by email or, if you prefer to speak to us, you can reach us in the UK on +44 (0) 208 0044900 or in Hong Kong on +852 39039004.

Please note

Crypto assets are not regulated financial products so please be aware that trading them carries a considerable amount of risk for your capital. Cryptocurrencies are also not covered by existing consumer protection laws.

Production

Production