A key part of the adviser/client relationship is creating your financial plan.

This will be the culmination of a detailed analysis of your current financial situation, as well as your future plans and aspirations.

Putting that plan together should just be the first step in a long journey, rather than a one-off event. In fact, it would be negligent of me if I allowed the latter to happen.

In the spirit of the approaching festive season, read on to find out why financial advice should be for life and not just for Christmas, as I outline some of the main features of our ongoing advisory service.

We recommend a structured review process

To manage your long-term financial future, I would always strongly recommend that your plans are reviewed at least annually.

That review will be a major event, involving detailed discussions about any recent or upcoming changes that could affect your plans.

We’ll also make full use of cashflow forecasting that can help you look ahead, and also assess the effect that specific events – such as a period of high inflation – could have on your finances.

In addition to your annual review, I’ll also organise a briefer half-year catch up where we can review progress. At this, you can share any recent changes to your circumstances that may entail alterations to your plan.

Dealing with other events that could affect your plans

Of course, there’s nothing whatsoever that prevents you from getting in touch between reviews. Whenever you call me, or one of my colleagues, we’ll be happy to help.

From experience, such calls tend to occur when a specific event has happened that’s causing you alarm, or made you think that your plans might need altering.

Such events could be external – stock market turmoil for example – or internal such as the arrival of a new child or a change of employment.

In each case, it can make sense to review your plans quickly and make any required changes without excessive delay.

Reacting to legislative and tax changes

Budget announcements and financial statements can clearly have an affect on your finances and, potentially, your long-term financial planning.

We’ll normally look to update you about the potential impact on your financial plans if we feel you should expedite any changes.

Likewise, if there are any serious changes to taxation legislation in either the UK and Hong Kong that could affect you, we would also recommend reviewing your plans. Quite often such changes can be hidden in the small print, so you may not be aware of the potential effects.

If you’re planning to return to the UK

Another key event that will affect your financial plans is if you’re planning to return to the UK after a period as an expat in Hong Kong.

My recommendation to you if you’re planning such a move is to get in touch as early in the process as possible. As with any key event, the more time you have to plan the better – and that very much applies to your financial plans if you’re thinking of such a major step.

The earlier you start planning the better the chances of a successful transition, and the less likelihood of you making any potentially costly mistakes.

Of course, if your move does come up at short notice, then we’ll react quickly and expedite the planning process we go through in such circumstances.

Even if you’re just idly toying with the idea of returning home, get in touch. We’ll be able to give you some handy tips and pointers when it comes to managing your finances.

Access to peripheral financial services

As part of our ongoing relationship, we would look to identify needs or opportunities for you to access financial-related services that we don’t necessarily offer but where we can recommend third parties to act on your behalf.

One key point to remember is that if we get an introducer fee from any service provider we recommend, we’ll rebate this directly to you.

Some examples of services you might want to access include:

Will writing

Making a will is a key part of your financial plan. It’s important to get the details correct, and to regularly review it to ensure it remains fit for purpose.

We may advise you on the things you might want your will to include, but for the expertise necessary to complete it, we’d recommend one of our third-party partners.

We work closely with a number of appropriate professionals in this area and would happily introduce you to them.

Currency exchange

If you’re travelling abroad regularly or, more importantly, if you’re returning to the UK, then we would strongly recommend you use a currency exchange specialist.

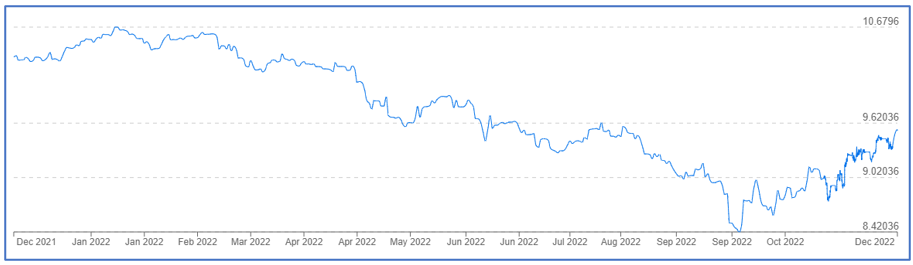

As you can see from the chart below, the Hong Kong dollar (HKD) to UK sterling exchange rate has fluctuated by more than 25% in the last 12 months. If you’re moving large sums of money, you’ll want to ensure you’re getting the best possible exchange rate.

We will be happy to recommend a specialist currency exchange expert to you.

Mortgage

Even in supposedly straightforward circumstances, the housing market can be a minefield. So if you’re moving from one country to another, you’re adding an extra layer of complexity to the sale and purchase process.

In this instance it’s essential to have a property expert acting on your behalf – particularly if you’re thousands of miles away.

Then there’s the added challenge of getting the best possible deal on your mortgage borrowing.

We have links with mortgage and property specialists we’d happily recommend to you in both the UK and Hong Kong.

Get in touch

If you’d like to discuss your financial plans and find out how we can help you, please contact us by email or, if you prefer to speak to us, you can reach us in the UK on +44 (0) 208 0044900 or in Hong Kong on +852 39039004.

Production

Production