At the start of the new year, it’s traditional for financial journalists to make predictions for the coming 12 months.

Most financial papers will feature articles looking ahead, including share tips, market sectors to keep an eye on, and big trends to expect.

Of course, they might not be so quick to reveal the predictions they made this time last year!

Rather than make similar predictions for you about what we think will happen, we thought we’d take a rather contrary approach to the idea.

So, read about five finance-related predictions we’re quite certain you won’t read about anywhere else.

1. It will still be difficult to predict top-performing sectors

Nearly 60 years ago, Bob Dylan penned his classic anthem for disaffected youth, ‘The Times They Are a-Changin’.

It was a song about social unrest but the line “the first one now will later be last” could just as easily been a reference to investment markets.

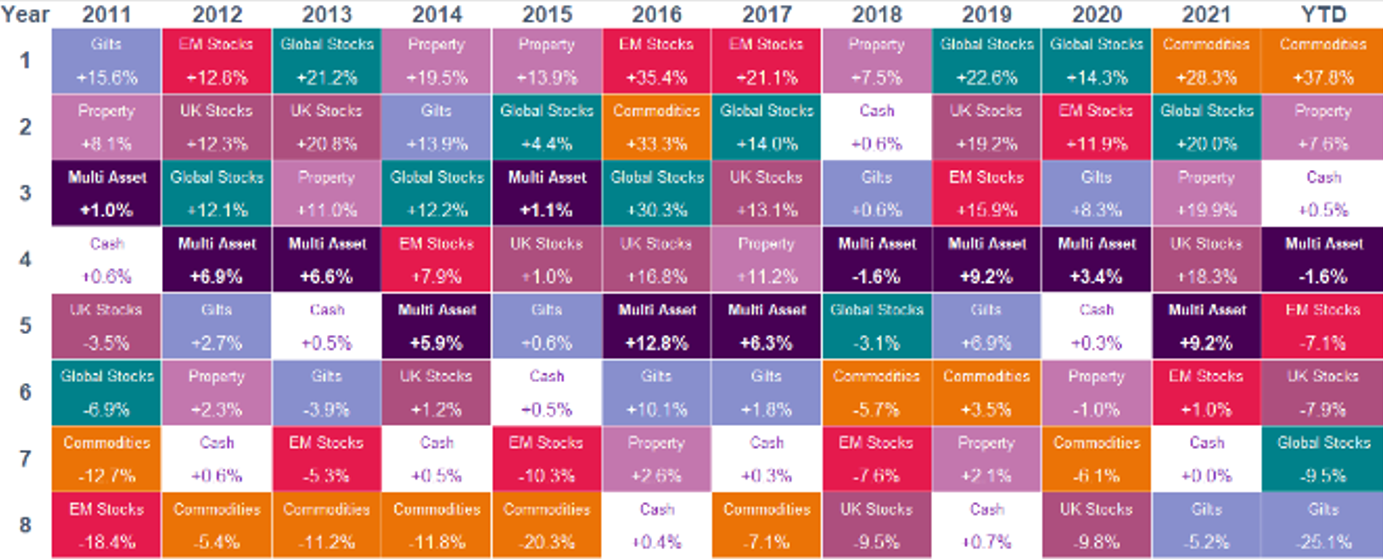

The table below illustrates this for you.

It shows eight key investment market sectors, and their comparative year-on-year performance over the last 12 years.

Source: Royal London

This demonstrates how hard it is to select top-performing sectors – let alone individual funds – despite what financial analysts will tell you.

For example, if you let your eye follow the orange blocks (commodities) or the red ones (emerging markets) you’ll see dramatic year-on-year fluctuation.

The one sector that has shown any kind of consistency during this this period is multi-asset funds, illustrated by the dark purple blocks. As you can see, they’ve maintained a steady mid-table position.

The clear underlying message is that if your portfolio is overweight in one particular market, you’re likely to see inconsistent performance with very good years easily followed by periods of below average performance.

2. The media will continue to overreact to market events

We can safely predict now that after a rocky couple of days for stock markets, financial headlines will reference the “billions wiped off share values”.

They’ll probably use one of the stock images of stressed traders in colourful jackets frantically waving at each other across a room, ignoring the fact that such images are out of date as nearly all trades are now conducted online.

We can be as equally certain that when markets recover the ground they lost, there will be a conspicuous lack of coverage for this positive news.

The financial media tends to feed off bad news – particularly in these days of clickbait and the struggle to attract a sustainable readership.

The best thing to do is to ignore the overwrought headlines and focus on long-term market performance rather than what happens on a single day.

3. Some fund managers will break their crystal balls

As well as over-hyping bad news, there’s also tendency in the specialist financial press to focus too heavily on the positive performance of individual fund managers.

They are far too quick to anoint new investment “stars,” with the implied message that he or she has discovered the secret of alchemy.

You only need to think of the way Neil Woodford was heralded as an investment genius, simply because of his contrarian attitude to prevailing orthodoxy, to see how dangerous such hyping can be. His fall came much more quickly than his rise!

There are some very effective and astute fund managers out there, but they tend to keep their heads down and focus on research and careful asset allocation rather than trying to boost their profile.

4. Investors will sell when they shouldn’t

All the market hype you read about in the previous two sections will have the effect of encouraging investors to buy and sell at precisely the wrong times.

As is often the way when there’s a sudden and dramatic market downturn, many people will panic and start selling their holdings to avoid future losses.

In reality, reacting to bad investment news by buying more stocks and taking advantage of falling prices can be a prudent approach.

One key point nearly always overlooked is that the value of shares or funds is only relevant when you come to sell them.

As Warren Buffett – one of the investment sages worth paying heed to – said, “be fearful when others are greedy, and greedy when others are fearful”.

5. The time machine will remain a thing of science fiction

It’s a little-known fact that, each Christmas in their letter to Santa, everyone involved in investment markets asks for one of the DeLorean cars seen in the film Back to the Future.

In reality, such time machines are, and will remain, the stuff of science fiction – although we can probably expect Elon Musk to start dropping hints that he may be producing a prototype machine soon!

Joking aside, this does reveal an important truth that no one can safely predict the future with any accuracy.

The best they can do is to use previous activity to suggest what might happen but, as you’ll often read in investment literature, past performance is no guide to the future.

Get in touch

If you’d like to discuss your investment requirements, please contact us by email or, if you prefer to speak to us, you can reach us in the UK on +44 (0) 208 0044900 or in Hong Kong on +852 39039004.

Production

Production